The Kenya Bankers Association (KBA) and Stakeholders drawn from various sectors of the economy will this year mark the International Day of Persons with Disabilities with the launch of a banking industry online platform that has been designed to train bank employees on bank-environment Kenyan Sign Language (KSL) vocabulary.

Central Bank of Kenya (CBK) Governor Dr. Patrick Njoroge was the Chief Guest during the unveiling of Kenya Bankers Association’s Deaf eLimu Banking Website and Mobile Application on Thursday.

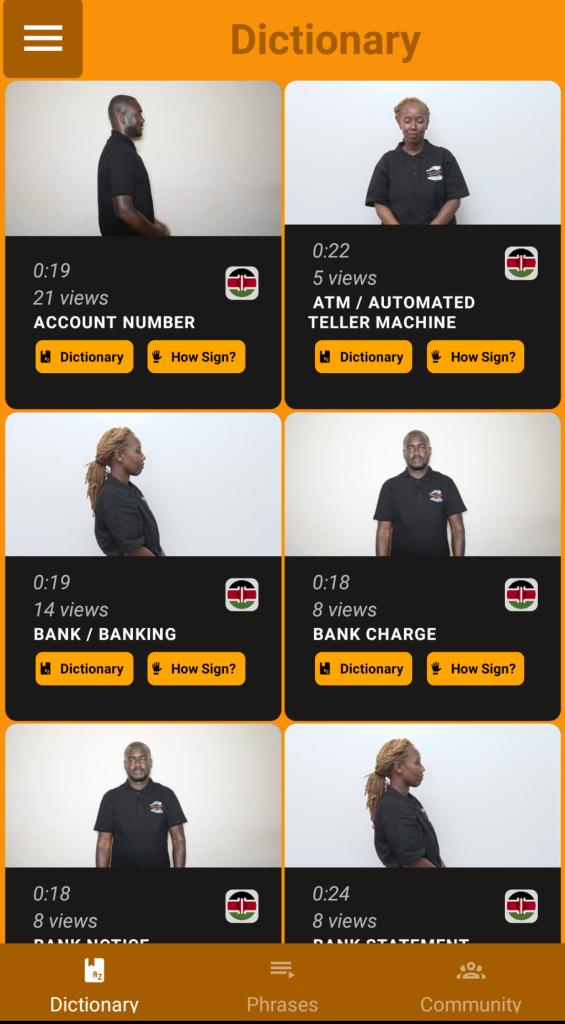

The innovation will be the first bank-environment sign language self-training application in Africa. As at launch on December 2nd, 2021, the Website and Mobile Application (Google Playstore) will feature 100 words and common banking environment phrases with video demonstrations and notes.

The platform will also have a moderated community section, where users can upload videos on how to sign additional words, thereby providing a dynamic way for the vocabulary to be increased over time and with participation from the banking community and Clients with Disabilities. The software has been developed and will be moderated by Deaf eLimu Plus Ltd, with funding from KBA and FSD Kenya.

Themed “Expanding Inclusion for People with Disabilities Through Innovation,” the forum will feature discussions during which speakers will explore private sector-led initiatives that can be implemented across industries towards enhancing the participation of People with Disabilities in the socio-economic development agenda of the country. Invited guests include various bank chief executive officers and industry stakeholders.

Among the speakers for the virtual event were KBA Chief Executive Officer Dr. Habil Olaka; FSD Kenya Chief Executive Officer Tamara Cook; Deaf eLimu Plus Founder Hudson Asiema; Kenya Private Sector Alliance Chief Executive Officer Carole Kariuki; KBA Public Affairs Director Nuru Mugambi; Kenya Society for the Blind Executive Director Samson Waweru; Safaricom Foundation Senior Manager Henry Kilonzo; Federation of Kenya Employers Projects Manager Catherine Naserian; inABLE Founder and Executive Director Irene Mbari-Kirika; and Bruce Cahan( Founder and CEO of Urban Logic, Stanford University lecturer on Ethics of Finance Sustainable Banking, and Co-founder of the Sustainable Banking Initiative at Stanford).

Dr. Olaka said the KBA has worked with banks to chart an industry roadmap that will help banks to follow international best practices in disability inclusion. “People with Disabilities constitute one of the most underserved segments of the population across jurisdictions. Despite gains achieved through initiatives geared towards promoting access to financial services in the last two decades, financial inclusion has not sufficiently impacted our Clients with Disabilities,” said Dr. Olaka. He noted that the Deaf eLimu Banking App and Website is an innovation arising from recommendations adopted in November 2020 by the KBA General Body following the Association’s PWD Digital Accessibility Project.

“The Project proposals are broad in scope, and touch on a wide spectrum of challenges faced by bank customers with disabilities, including independently accessing mobile banking applications, online banking channels, bank Websites, bank statements, and ATMs,” said Dr. Olaka. Among the KBA recommendations was a requirement that banks train customer-facing branch staff on Persons with Disabilities Etiquette and basic Kenyan Sign Language (KSL).

KBA Roadmaps & Forecasts for PwD.

To date, 31 KBA member banks have developed internal roadmaps that identify milestones towards digital accessibility. Bank initiatives include Kingdom Bank, which partnered with the Kenyan Paraplegic Organization to enhance inclusion and diversity responsiveness across the bank. Meanwhile, banks such as KCB, DTB and Absa have taken to social media to promote KSL via the hashtag #SignLanguageChallenge. KBA has also partnered with FSD-Kenya to promote the International Day of Persons with Disabilities which is observed annually on 3rd December.

Also Read: KBA, KCIC Sign Deal Aimed at Advancing Green Financing in Kenya

GME

GME AMC

AMC