Asia-Pacific markets mostly fell on Tuesday as investors remain concerned about inflation as well as likely policy tightening from central banks such as the U.S. Federal Reserve.

Japan’s Nikkei 225 declined 0.9% to 28,222.48 while the Topix index fell 0.44% to 1,986.82. The Japanese market was closed in the previous session for a public holiday.

South Korea’s Kospi wavered between gains and losses before finishing near flat at 2,927.38. The Kosdaq struggled and declined 1.07% to 969.92. In Hong Kong, the Hang Seng index finished fractionally lower at 23,739.06.

Chinese mainland shares lost momentum and major indexes slipped: The Shenzhen component dropped 1.27% to 14,223.35 while the Shanghai Composite was down 0.73% at 3,567.44.

Elsewhere in Asia, the ASX 200 in Australia fell 0.77% to 7,390.1. The heavily-weighted financials subindex declined 0.99% as the country’s major banking names sold off amid growing expectations that the U.S. central bank might raise rates quicker than previously anticipated. Commonwealth Bank of Australia shares declined 1.51% and ANZ fell 1.3%.

Major stock averages in India rose in afternoon trade, with the Nifty 50 up 0.23%.

Tuesday’s session in Asia followed overnight declines in the U.S. where the Dow Jones Industrial Average and S&P 500 fell. But, the Nasdaq finished fractionally higher in regular trading.

Rising bond yields pressured stocks in the previous week. The yield on the benchmark 10-year Treasury note ticked down 1.76% Monday afternoon stateside after breaching 1.8% earlier in the day. By comparison, the yield on the 10-year note ended 2021 at 1.51%.

“At this juncture, this may be the short pause amid recent yield surges and equities declines, for markets to now consider the finer details of rate hikes, though surely not the final resting points,” Tan Boon Heng from Mizuho Bank wrote in a Tuesday note.

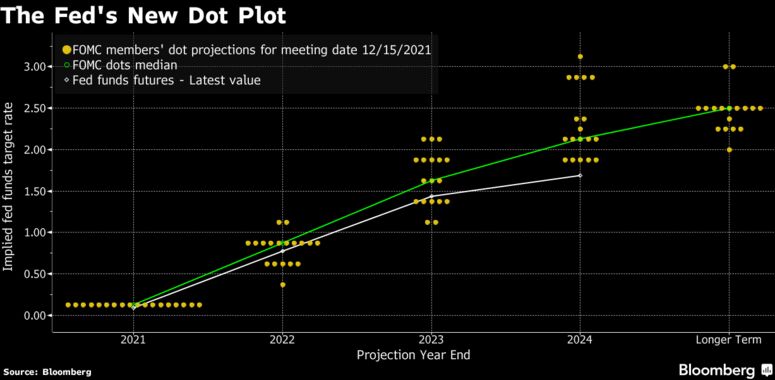

Fed officials have already indicated that they plan to restrict access to cash faster than previously expected.

Markets in Asia anticipate a 76% chance the U.S. central bank hikes interest rates at its March policy meeting, up from about 15% in mid-October, according to the CME Group’s FedWatch site.

Jerome Powell is set to appear before Congress on Tuesday for his nomination hearing after President Joe Biden last year picked the incumbent Fed Chair for a second term to lead the central bank. In prepared remarks, Powell said the Fed will “use our tools to support the economy and a strong labour market and to prevent higher inflation from becoming entrenched.”

Lael Brainard, whom Biden nominated to be the central bank’s next vice chair, will testify on Thursday.

Both testimonies could shed some light on their monetary policy tightening intentions, according to analysts at Singapore’s OCBC bank.

“As it is, there is already market speculation that there may be up to four 25bp rate hikes by the Fed this year, starting as early as March, and adding fuel to the fire would be any quantitative tightening in the form of running off the size of its balance sheet thereafter,” the analysts wrote in a Tuesday morning note.

Asian Markets Currencies & Oil

The U.S. dollar dipped 0.23% to 95.775 against a basket of its peers, withdrawing from its previous close at 95.991.

Elsewhere, the Japanese yen changed hands at 115.24 per dollar, strengthening from an earlier level around 115.38. The Australian dollar traded up 0.25% to $0.7186.

Oil prices rose during Asian trading hours, with U.S. crude adding 1.1% to $79.09 a barrel while global benchmark Brent added 0.98% to $81.66. Prices fell in the previous session on the back of demand worries amid a rise in global Covid cases.

“Investors in Asia are closely watching China’s Omicron spread, as policy could trigger more travel restrictions,” ANZ Research analysts said in a morning note.

“But the market could still benefit from tighter supplies and supply risk from Russia. OPEC’s production for December continued to be lower than committed, production increased by 70,000b/d in December,” they added.

GME

GME AMC

AMC