Shares in Asia-Pacific were mixed on Thursday, as investors reacted to data out of Australia and China.

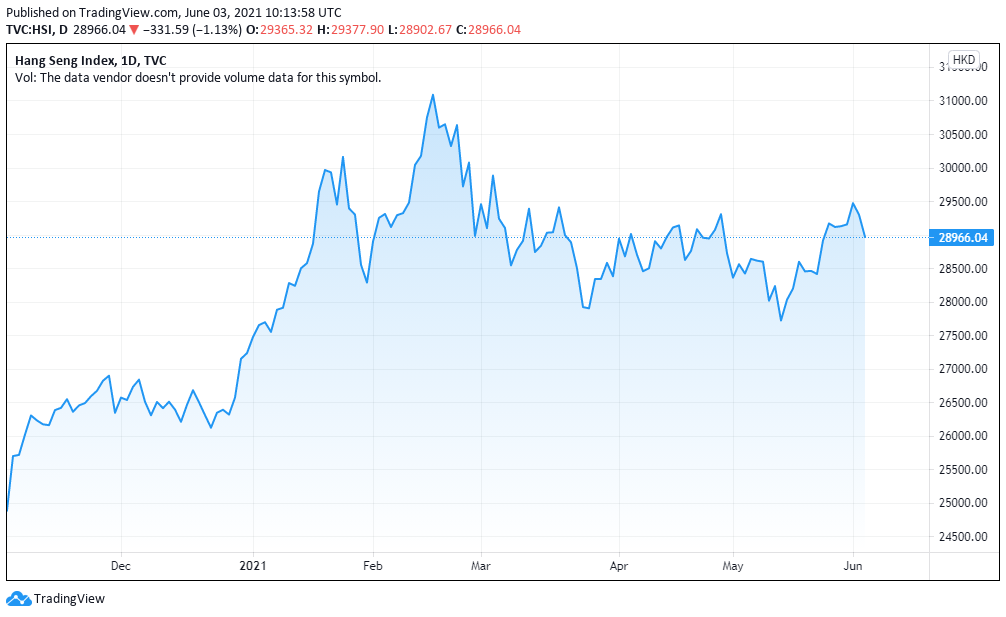

Hong Kong’s Hang Seng index led losses regionally, falling 1.13% on the day to 28.966.03.

A private survey released Thursday showed slowing Chinese services activity growth in May. The Caixin/Markit services Purchasing Managers’ Index for May came in at 55.1 on Thursday, lower than the reading of 56.3 in April. Still, that was well above the 50 level that separates expansion from contraction.

PMI readings above 50 represent expansion while those below that level signify contraction. PMI readings are sequential and represent month-on-month expansion or contraction.

South Korea’s Kospi closed 0.72% higher at 3,247.43.

Elsewhere in Japan, the Nikkei 225 gained 0.39% to close at 29,058.11 while the Topix index ended the trading day 0.84% higher at 1,958.70.

MSCI’s broadest index of Asia-Pacific shares outside Japan slipped 0.13%.

Asian Markets Currencies and oil

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 90.071 following an earlier low of 89.887.

The Japanese yen traded at 109.79 per dollar, weaker than levels below 109.5 seen against the greenback earlier this week. The Australian dollar changed hands at $0.7728, having seen an earlier high of $0.7754.

Oil prices rose for a third day on Thursday on expectations for a surge in fuel demand, particularly in the United States and Europe and China, later this year at the same time major producers are maintaining supply discipline.

Brent crude futures were up 49 cents, or 0.7%, at $71.84 a barrel by 0233 GMT, the highest since September 2019. The international benchmark gained 1.6% on Wednesday.

U.S. West Texas Intermediate crude futures rose 44 cents, or 0.6%, to $69.27 a barrel. Prices earlier rose to as much as $69.32, the most since October 2018, after gaining 1.5% in the previous session.

GME

GME AMC

AMC