Gold prices languished near multi-month lows on Tuesday, hurt by a rise in U.S. bond yields and a stronger dollar after robust U.S. jobs data last week raised bets over the Federal Reserve tapering stimulus earlier than expected.

Spot gold was little changed at $1,730.47 per ounce by 0039 GMT. On Monday, prices touched $1,684.37, their lowest since March 31 while U.S. gold futures edged 0.4% higher to $1,732.90 per ounce.

The dollar index firmed near more than a two-week high, making gold more expensive for holders of other currencies.

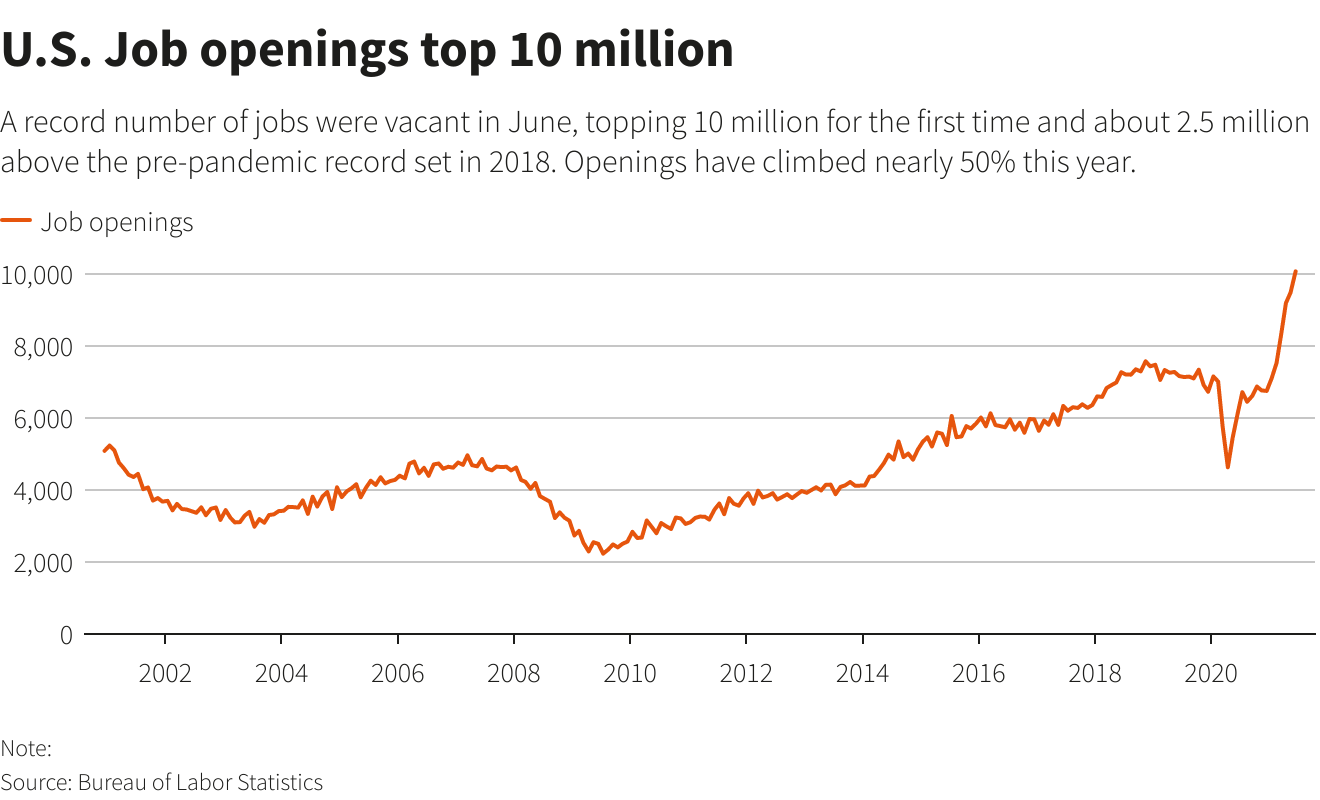

U.S. Treasury yields rose to a more than three-week high as record-high job openings on top of stronger-than-expected employment gains in July added to the narrative of an improving labor market.

Job openings, a measure of labor demand, shot up by 590,000 to a record high of 10.1 million on the last day of June, the U.S. Labor Department reported in its monthly Job Openings and Labor Turnover Survey (JOLTS).

Some investors view the yellow metal as a hedge against higher inflation, but a Fed rate hike would dull bullion’s appeal as that increases the opportunity cost of holding the non-yielding metal.

SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.2% to 1,023.54 tons on Monday from 1,025.28 tons on Friday.

Silver was steady at $23.43 per ounce after falling to an eight-month low in the previous session. Platinum edged 0.1% higher to $980.81 and palladium rose 0.1% to $2,603.20.

Also Read: Gold Steady at 4 Month High Supported by Dropping Treasury Yields

GME

GME AMC

AMC