The Executive Board of the International Monetary Fund (IMF) has approved the immediate disbursement of Kes. 29.2 billion to Kenya under the Extended Credit Facility (ECF), in a move meant to support Kenya’s program to address debt vulnerabilities and their response to the COVID-19 pandemic and at enhancing governance.

On Friday, the board, following a consultative meeting agreed on the disbursement of the money, bringing the total amount disbursed to the country for budget support to Kes. 100 billion.

“The Executive Board completed the 2021 Article IV Consultation and the Second reviews of the 38-month Extended Arrangement under the Extended Fund Facility (EFF) and 38-month arrangement under Extended Credit Facility (ECF) for Kenya. The board has agreed to the immediate disbursement of USD258.1mn (Sh.29.2Bn) to Kenya,” IMF said in a statement.

The Fund had approved a USD2.34bn (Sh266bn) aid package for Kenya in April 2021 to be disbursed over 38 months, under the Extended Credit Facility and the Extended Fund Facility.

Deputy Managing Director and Acting Chairperson of the Executive Board, Antoinette Sayeh, said Kenya had shown remarkable resilience to the COVID shock in 2020 and is staging an economic recovery.

She noted that growth is now estimated to accelerate to 5.9 per cent in 2021 and that the country’s COVID-19 vaccination program has picked up speed in the second half of 2021.

“The political calendar is also a source of uncertainty,” she said.

Sayeh said the board believed that the additional support would further aid in making advances to the country’s structural reform and anti-corruption agencies.

She further noted that the funding is expected to strengthen domestic revenue mobilization and expand the country’s ongoing COVID-19 vaccination drive.

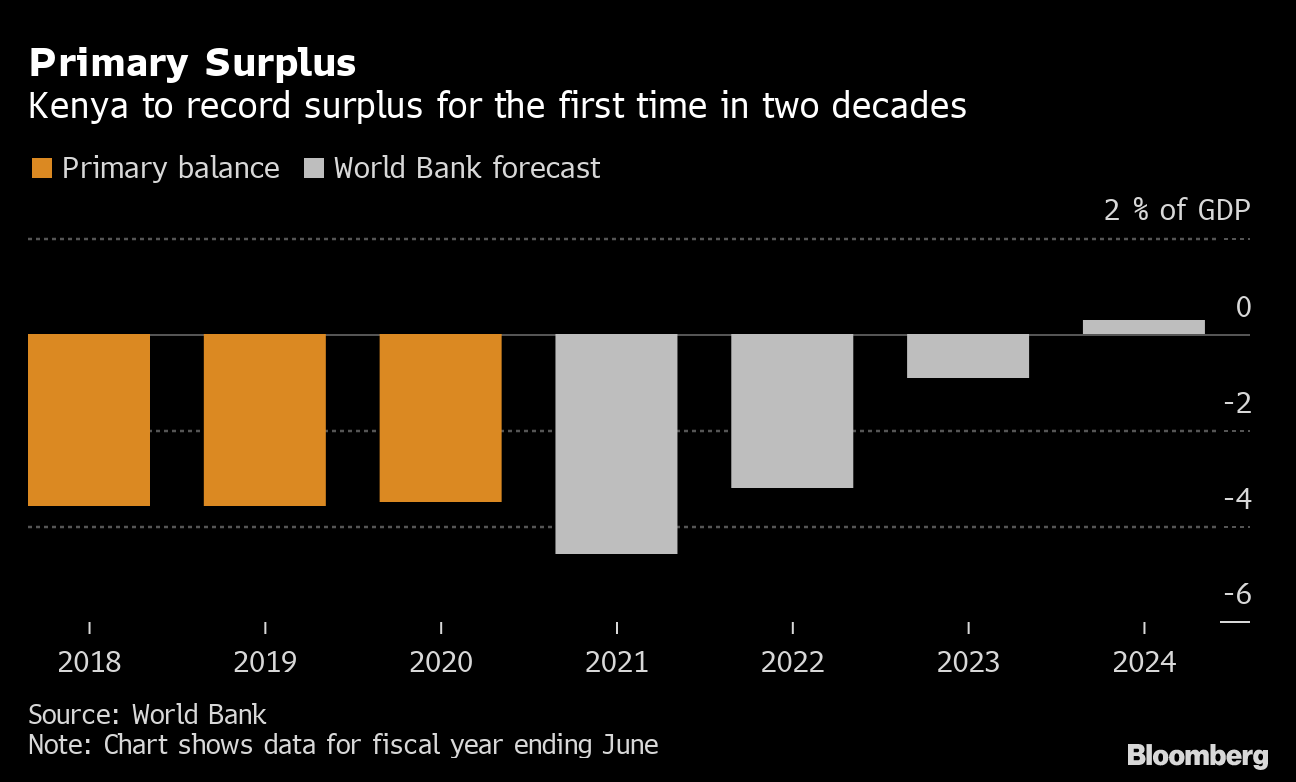

“The authorities should continue executing their multi-year fiscal consolidation plan to reduce debt vulnerabilities. Some additional fiscal space is needed in FY21/22 for emergency spending to face the drought in the north and emerging security needs; the planned supplementary budget should also provide resources for expanding COVID-19 vaccinations and SOEs support, in line with program design. Strengthening domestic revenue mobilization, maintaining expenditure control while protecting priority social spending and improving spending efficiency will remain essential. Bold political commitment by all levels of government is needed to ensure the FY22/23 budget is aligned with the authorities’ program.

“Proactive efforts to address fiscal risks from state-owned enterprises (SOEs) should continue. Financial support to SOEs will require difficult tradeoffs and adequate safeguards given Kenya’s limited fiscal space and the need to maintain debt sustainability.

“Further strengthening fiscal transparency and governance requires more proactive efforts. The authorities should address legal impediments to begin publishing beneficial ownership information for awarded public tenders in early 2022, proceed with planned audits of COVID-19 spending, and promptly act to follow up on previous audits.

IMF on CBK Policies

“Well-calibrated Central Bank of Kenya policies have supported economic resilience and the banking sector. The stance of monetary policy should remain accommodative as long as inflation expectations remain well-anchored.

“The program is subject to increasing global and domestic risks, including from the pandemic, tightening global financing conditions, and potential pressures from the upcoming political calendar. Kenya’s medium-term prospects remain positive, and the authorities’ continued commitment to their economic program is essential to maintain macroeconomic balance while ensuring a more sustainable, greener, and inclusive growth.”

Also Read: Kenya’s Inflation Slows to a Six Month Low of 5.8% in November

GME

GME AMC

AMC