Oil prices edged up on Thursday, extending gains from the previous session, buoyed by lower crude inventories and higher gasoline demand in the United States.

Brent crude futures for September rose 40 cents, or 0.4%, to $107.02 a barrel by 0010 GMT, after gaining $2.22 on Wednesday.

U.S. West Texas Intermediate crude (WTI) was at $97.78 a barrel, up 52 cents, or 0.5%, after rising $2.28 in the previous session.

U.S. crude oil stockpiles fell by 4.5 million barrels last week, while U.S. gasoline demand rebounded by 8.5% week on week, according to data from the Energy Information Administration.

Exports also climbed to a record high as WTI traded at a steep discount to Brent, making purchases of U.S. crude grades more attractive to foreign buyers.

On the demand side, the U.S. Federal Reserve raised its benchmark overnight interest rate by three-quarters of a percentage point, in line with expectations, to cool inflation, while the dollar fell on hopes for a slower hiking path.

The weaker dollar also helped crude oil prices notch some gains as it makes oil, priced in dollars, cheaper for buyers in other countries to purchase.

Oil Prices also found support as the Group of Seven richest economies aims to have a price-capping mechanism on Russian oil exports in place by Dec. 5, a senior G-7 official said on Wednesday.

U.S. crude oil production growth could also be limited by the availability of fracking equipment and crews, as well as capital constraints, executives said this week.

Oil Prices to Rise as Demand Grows with Russia Cutting Nord Stream 1 Link.

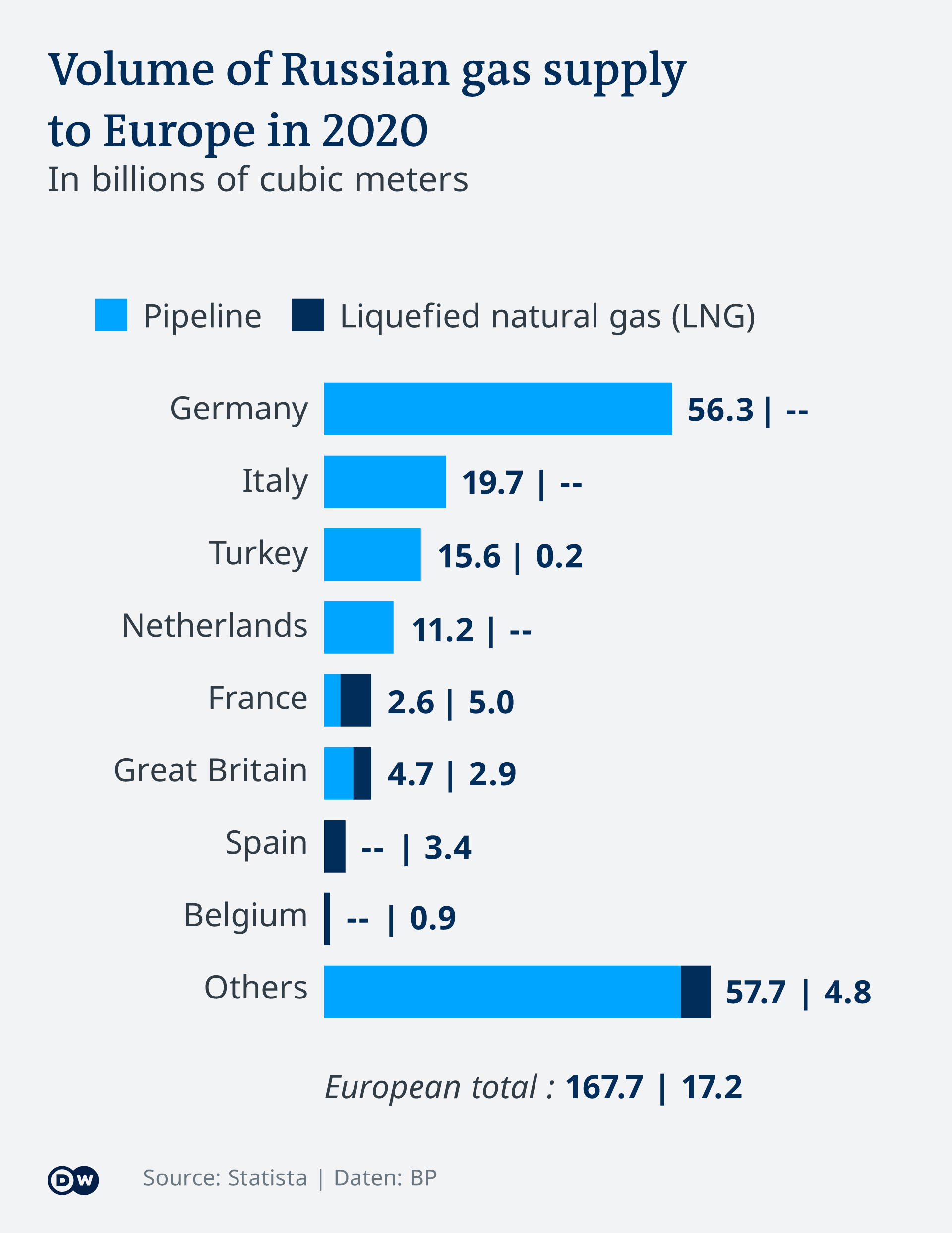

In the meantime, Russia has cut gas supply via Nord Stream 1 — its main gas link to Europe — to just 20% of capacity. That could lead to switching to crude from gas and prop up oil prices in the short term, analysts said.

The cut in supplies, flagged by Gazprom earlier this week, has reduced the capacity of Nord Stream 1 pipeline – the major delivery route to Europe for Russian gas – to a mere fifth of its total capacity.

On Tuesday, EU countries approved a weakened emergency plan to curb gas demand after striking compromise deals to limit cuts for some countries, hoping lower consumption will ease the impact in case Moscow stops supplies altogether.

GME

GME AMC

AMC