Global market headlines swung squarely to Fed policy and geopolitical uncertainties last week, while swings in the stock market remained narrow, continuing August’s tranquil trend.

United States

Stocks gained as full Food and Drug Administration (FDA) approval of the Pfizer-BioNTech COVID-19 vaccine supported sentiment toward an ongoing economic recovery. The tech-heavy Nasdaq Composite index outperformed the broad market S&P 500 Index and the large-cap Dow Jones Industrial Average. The Russell 2000 Index of small-cap stocks posted particularly impressive gains. Stocks in the energy sector jumped higher as crude oil prices gained about 10% for the week.

The global market participants were anticipating Friday’s speech by Fed Chair Jerome Powell at the Kansas City Fed’s Jackson Hole conference (held virtually for the second consecutive year) to see if he would provide any signs that the central bank could accelerate or slow its eventual tapering. However, the speech turned out to be a nonevent as Powell did not signal any deviation from the central bank’s recent assessment of economic conditions or outlook for removing policy accommodation.

U.S. Treasuries posted negative total returns in global markets as yields increased. (Bond prices and yields move in opposite directions.) The week’s positive economic data helped push yields higher while improving sentiment toward riskier assets such as equities also weighed on demand for Treasuries, which investors view as a lower-risk asset class. The broad municipal bond market registered modestly negative returns through most of the week but held up better than Treasuries.

| Index | Friday’s Close | Week’s Change | % Change YTD |

| DJIA | 35,455.80 | 335.72 | 15.84% |

| S&P 500 | 4,509.37 | 67.70 | 20.06% |

| Nasdaq Composite | 15,129.50 | 414.84 | 17.39% |

| S&P MidCap 400 | 2,767.06 | 91.39 | 19.96% |

| Russell 2000 | 2,277.15 | 109.55 | 15.31% |

Shares in Europe gained ground on the watch of global market central banks’ accommodative policies, signs that economic growth remained strong in August and hopes that higher vaccination rates might help to prevent hospitalizations and deaths stemming from COVID-19 from reaching previous highs as economies reopen and case counts increase. In local currency terms, the STOXX Europe 600 Index advanced 0.75%. Country-specific indexes also moved higher. France’s CAC 40 Index climbed 0.84%, Italy’s FTSE MIB Index ticked up 0.34%, and Germany’s Xetra Dax Index added 0.28%. The UK’s FTSE 100 Index gained 0.85%.

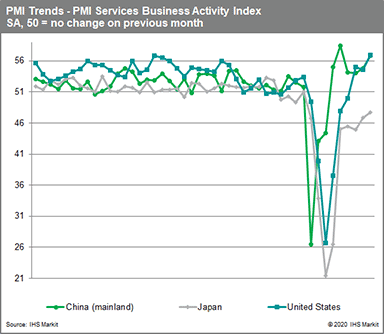

The eurozone economy appeared to remain in expansion mode in August, in line with various global market analysts, with the early headline number for IHS Markit’s composite Purchasing Managers’ Index (PMI) coming in at 59.5, a strong reading that was down modestly from the 15-year high of 60.2 registered in July. (PMI readings greater than 50 indicate an expansion in economic activity levels.)

The flash reading for IHS Markit’s UK composite PMI tumbled to 55.3 in August compared with 59.2 in July. Whereas the reading for the manufacturing sector slipped 30 basis points to 60.1, the PMI for the services sector contracted to 55.5 from the 59.6 record during the previous month. The news release noted that survey participants cited staffing shortages as one constraint on the recovery. The Financial Times reported that the UK government would roll out a program to deliver booster shots of the coronavirus vaccine to the most vulnerable populations, beginning in early September, and later expand eligibility to those 70 years and older.

Asia

Chinese stocks continued to recover from their late-July lows. The Shanghai Composite Index rose 2.8% and the large-cap CSI 300 Index gained 1.2%. In the bond market, the yield on the 10-year central government bond edged up two basis points to 2.89%. The renminbi currency appreciated slightly against the U.S. dollar to close at 6.480.

Early in the week in the global markets, the People’s Bank of China (PBOC) met with leading financial institutions to urge them to strengthen credit support to the economy. The meeting is significant because credit growth accelerated after the central bank held similar meetings in 2018 and 2019, according to CLSA, and suggests that policy is shifting toward further easing amid an uneven economic recovery. Possible easing measures for the PBOC include accelerated government bond issuance across various global markets, an expansion in the loan quota for some banks, or a cut in banks’ required reserve levels.

In global markets regulatory news, the China Securities Regulatory Commission pledged to cooperate with their U.S. counterparts regarding the auditing of Chinese companies that trade in the U.S. The years-long dispute with the U.S. stems from China’s refusal to provide full access to the financial data of Chinese companies that trade in the U.S. on national security grounds. Separately, China sought to clarify misconceptions over the term “common prosperity,” a slogan recently emphasized by President Xi Jinping amid a crackdown on the technology sector.

Japan’s stock markets posted some of the most impressive rise in global markets for the week, with the Nikkei 225 Index gaining 2.31% and the broader TOPIX Index up 2.01%, despite more negative developments on the coronavirus front. The yield on the 10-year Japanese government bond ticked up slightly to 0.02% (from 0.01% the prior week) while the yen fell to JPY 109.9 against the U.S. dollar (from the previous week’s JPY 109.7).

The Japanese government extended its COVID-19 state of emergency, one of the tightest for a global market, to eight more prefectures, with the measures set to last until September 18. Prime Minister Yoshihide Suga said that infections are spreading on an unprecedented scale in most regions across the country and acknowledged that the medical system is in a severe situation. However, Japan has been speeding up its belated vaccination drive in recent months, and Suga highlighted that about 60% of the country’s population will have been fully vaccinated by the end of September.

Other Key Global Markets

- South Korea – The Bank of Korea is the first major global markets central bank in Asia to raise its benchmark policy interest rate since the coronavirus pandemic began in the spring of 2020. South Korea’s central bank decided to hike rates 25 basis points to 0.75% from 0.50% this week. The move was generally expected as the bank wants to stem rising inflation, higher household debt, and a surge in housing prices. The central bank kept its gross domestic product growth forecast steady at 4.0% and 3.0% for this year and next, respectively. However, it increased its inflation projection to 2.1% for the fiscal year from 1.8% and ratcheted up its inflation forecast for 2022 to 1.5% from 1.4%.

- South-East Asian Markets – Southeast Asia’s strong economic recovery from the global pandemic lows is stalling due to the surge in the number of cases of the delta variant of the coronavirus. Lockdowns in the region are crimping economic activity in both the services and manufacturing sectors, which is likely to cause a slowdown in corporate profit and gross domestic product growth in the third quarter. The hyper-contagious nature of the delta variant coupled with low vaccination rates, especially in emerging markets, has taken the wind from the sails of many companies in the region. According to Refinitiv Eikon analysis of more than 1,000 companies, Southeast Asia is forecast to suffer its first quarter-over-quarter decline in six quarters in the period ended September 30 (although year-over-year data should remain strong due to the weakness versus the year-ago period).

GME

GME AMC

AMC