US markets experienced a turbulent trading session on Thursday, March 27, as investor anxieties surrounding newly announced tariffs and their potential economic repercussions took center stage. The technology sector bore the brunt of the sell-off on US Markets, contributing to significant declines across major indices compared against Wednesdays trading session.

The primary catalyst for the US market’s decline was the announcement of new tariffs on cars manufactured outside the US Market by the Trump administration on Wednesday. This move ignited fears of a potential trade war, particularly with Japan and Canada and other trading partners, leading to widespread market uncertainty.

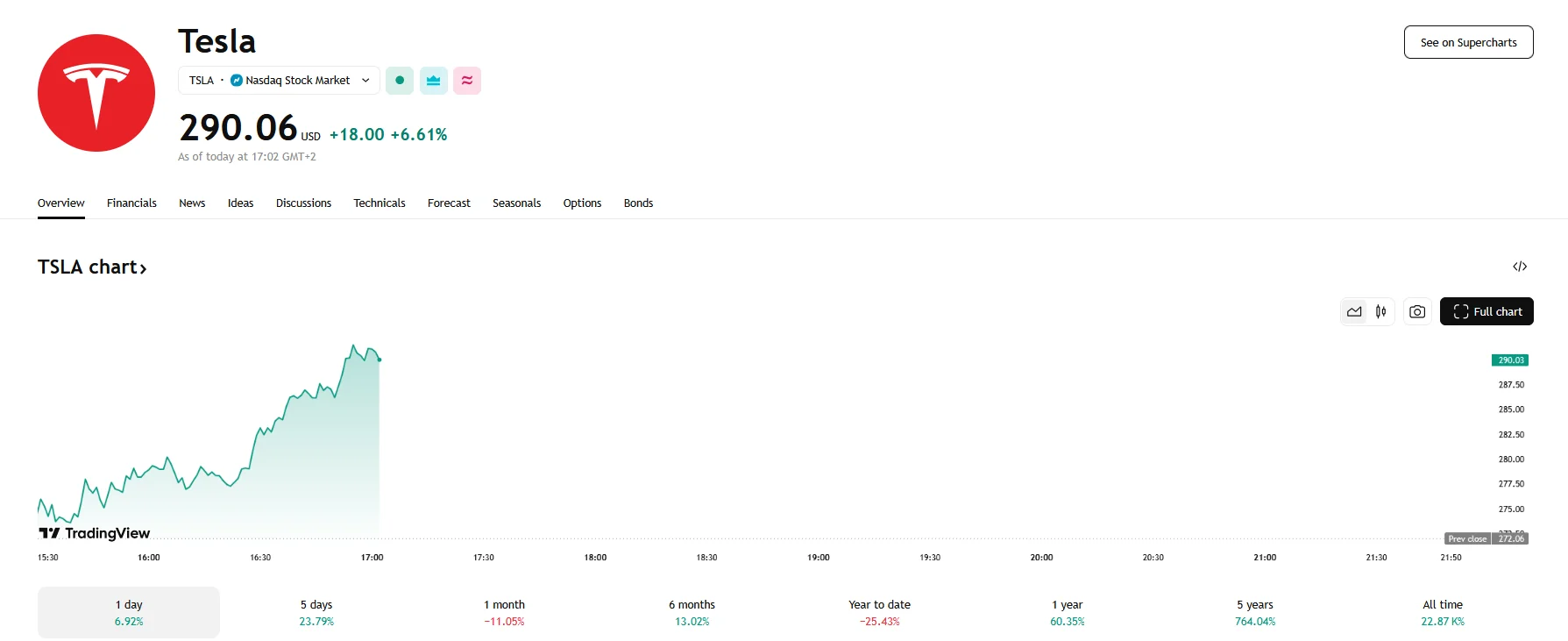

Automotive stocks on US markets experienced a dramatic shift following President Donald Trump’s announcement of a 25% tariff on all imported vehicles and certain auto parts, set to begin in April. This policy shift triggered a notable divergence in stock performance between traditional automakers and electric vehicle manufacturer Tesla.

Read: Japan’s Nikkei Decline as Asian Stocks Mixed on Global Uncertainties

The technology sector, which has been a significant driver of market growth, experienced a sharp sell-off. Companies like Nvidia saw notable declines, contributing heavily to the Nasdaq’s steep drop. Specifically, Tesla saw fair gains despite pressure due to potential impacts from Canadian EV subsidy adjustments.

Economic Data Excites Consumer Stocks on US Markets.

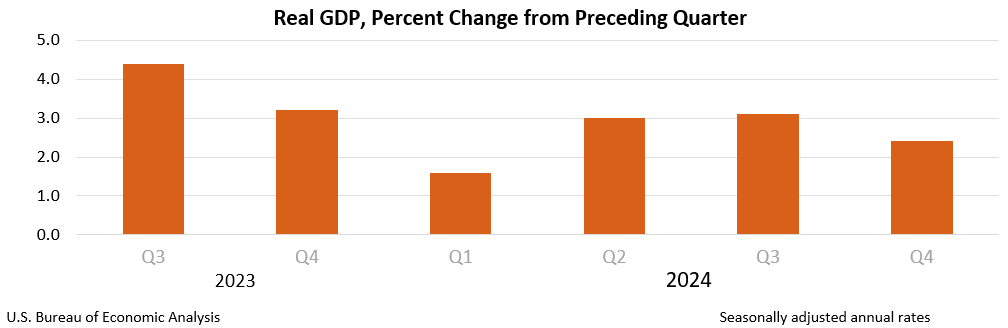

Conversely, economic data released during the day provided some mixed signals. The final estimate of U.S. fourth-quarter GDP exceeded expectations, indicating continued economic growth. However, this positive news was overshadowed by the prevailing tariff concerns. Specifically, U.S. Q4 GDP reached an annualized rate of 2.4%, surpassing estimates, and initial weekly jobless claims came in at 224,000, slightly below expectations.

Investor sentiment turned decidedly negative as the day progressed, driven by fears of escalating trade tensions and their potential impact on corporate earnings. The Cboe Volatility Index (VIX), a measure of market volatility, showed a rise, reflecting increased investor anxiety. Key market performance saw the S&P 500 closed at 5,693.31, down 18.89 points, or 0.33%, the Dow Jones Industrial Average fell 155.09 points, or 0.37%, to 42,299.70, and the Nasdaq Composite plunged 94.98 points, or 0.53%, to 17,804.03. The VIX rose to 17.29, indicating increased market volatility.

The Trading Room Analysts commented, ” This week, we have seen how quickly geopolitical events can shift US market sentiment, even amidst positive economic data.The market will be paying close attention to further economic data releases and corporate earnings reports for indications of the potential impact of the tariffs.”

Looking ahead, market participants in US Markets will closely monitor developments in the trade arena, particularly any responses from Canada and other affected nations.

GME

GME AMC

AMC